The Calculation

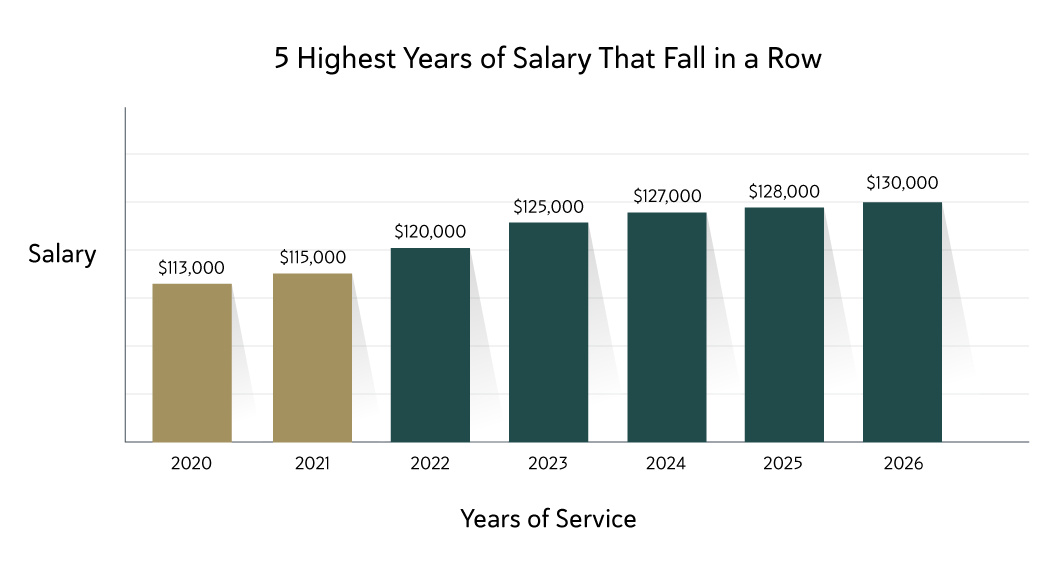

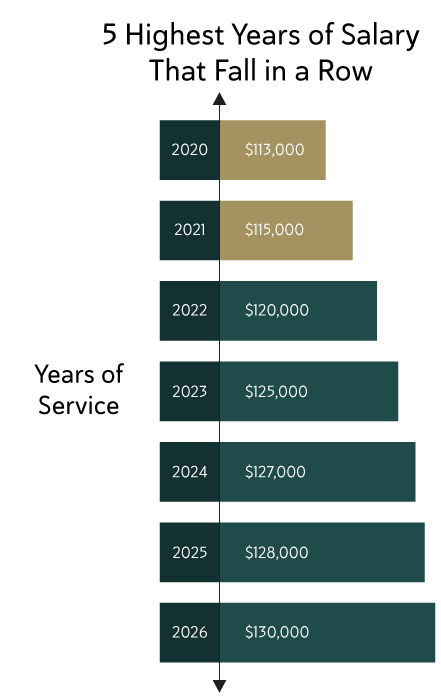

A Plan member’s pension benefit is based on their length of pensionable service, the average of their highest five consecutive years of pensionable salary, and a benefit rate of 2%.

Example

A member has a highest average salary of $126,000 and has 20 years of pensionable service.

The final amount of a member’s pension is also based on when they retire, the pension option they choose at retirement, and whether they choose to coordinate their pension.

If a member has Combined Pensionable Service, this may also affect their pension benefit.

As situations, salary and service amounts are unique to every Plan member, the simplest way to run calculations or estimate pension benefits is by using either of the following tools:

- The Pension Estimator allows members to compare different scenarios by inputting their own estimated values for average salary, pensionable service and retirement age.

- The Pension Projection Calculator allows members to project the amount of their MEPP pension based on the actual information we have on file. This option is only available to members who have registered for Your Pension Profile, the secure, online portal that is part of this website.

Examples

Breaking Down the Pension Formula

Salary

The salary factor used in the formula to calculate a member’s pension is called the highest average salary. This determines the average from five consecutive years where their salary was the highest. Often, but not always, those are the last five years of a MEPP member's career.

Service

Another important component of the pension benefit calculation is pensionable service. This is the total amount of time a member was employed by a MEPP employer (or an employer that shares a transfer agreement with MEPP, and from which the member has opted to transfer their eligible service to MEPP) and actively contributing to the Plan.

Maximum Amount of Service

The Plan's maximum pensionable service is 35 years, or 35 years between MEPP and the Public Service Pension Plan (PSPP) if a member has Combined Pensionable Service. Service purchased through a buyback or transfer into MEPP also counts towards pensionable service.

Note

The Plan's maximum pensionable service is 35 years, or 35 years between MEPP and the Public Service Pension Plan (PSPP) if a member has Combined Pensionable Service. Service purchased through a buyback or transfer into MEPP also counts towards pensionable service.